Samsung Electronics reported financial results for the second quarter ended June 30, 2018. The Company posted KRW 58.48 trillion in consolidated quarterly revenue, down 4 percent from a year earlier, and KRW 14.87 trillion in quarterly operating profit, up 6 percent.

Second quarter revenue fell due to softer sales of smartphones and display panels, despite robust demand for memory chips. The continued strength of the Company’s memory business contributed to the higher operating profit. Net profit was little changed from a year earlier due to higher income tax.

Both revenue and operating profit decreased from the previous quarter. The Korean won weakened against the US dollar but rose against the euro and several other key currencies, resulting in a negative impact of net KRW 400 billion on the quarterly operating profit compared with the previous quarter.

By business unit, the Semiconductor Business continued to deliver strong earnings, driven by demand for DRAM chips used in data centers and NAND flash memory for high-capacity storage, amid a softening of NAND prices. Samsung solidified its competitive positioning by focusing on value-added products, including 64GB and higher-density server DRAM based on the 1X nanometer technology and 128GB and higher for NAND mobile storage.

In the Display Business, the Company saw weak demand for flexible OLED panels in the second quarter while the shipment and price for LCD panels also fell.

Amid the stagnant high-end smartphone market, the IT & Mobile Communications Division reported a drop in earnings, both year-on-year and quarter-on-quarter, over slow sales of the Galaxy S9. The network business, however, achieved solid growth led by investments in LTE networks by key global customers.

Stronger sales of premium TVs such as the QLED models, helped by a major global soccer event, lifted profits from the Consumer Electronics Division, although the Digital Appliances Business saw earnings decline due to weak demand for air conditioners.

Looking ahead, Samsung expects sustained strength in the memory market and growing demand for flexible OLED panels to drive earnings higher in the second half.

The outlook for the memory chip business remains strong across all applications thanks to demand for server and PC memory as well as new mobile product launches. Samsung will proactively address demand for differentiated products such as high-density server memory and High Bandwidth Memory. The Company will also strengthen its technological leadership by increasing the portion of 10 nanometer-class products and expanding mass production of 5th generation V-NAND.

The System LSI and Foundry businesses are set to benefit from higher demand for mobile APs and image sensors. Flexible OLED shipments are expected to rise, even as competition is seen intensifying over rigid products.

The mobile market condition will likely remain challenging in the second half amid pricing competition and new product launches. The Company will respond through the early introduction of the Galaxy Note and competitive mid- and low-end models with new features. Earnings from the TV business will continue to improve as Samsung expands sales of new innovative premium models including QLED and 8K TVs.

Over the mid- and long-term, Samsung expects new opportunities in the component business from the ongoing transformation in the industry, led by the Internet of Things (IoT), artificial intelligence (AI) and 5G technologies. The set businesses will also benefit from the introduction of new form factors and innovative technologies to support growing demand for connected devices.

In the component business, Samsung will use its cutting-edge semiconductor technology to capitalize on new demand for chipsets used in automotive and AI applications. The Company will also leverage its strength in OLED panels to take advantage of wider applications in the IT and automotive industries.

The Company’s capital expenditure in the second quarter was KRW 8.0 trillion, including KRW 6.1 trillion for the Semiconductor Business and KRW 1.1 trillion for the Display Business. It brings the total spent in the first half of 2018 to KRW 16.6 trillion.

Semiconductor to see Continued Strong Demand in Second Half

The Semiconductor Business posted consolidated revenue of KRW 21.99 trillion and operating profit of KRW 11.61 trillion for the quarter. The memory business achieved strong results despite weak seasonality, as overall demand growth was solid, driven by servers for data centers.

For NAND, demand remained robust on the back of the continuing trend toward higher density for smartphones and the increase in demand for server SSD due to expansion of cloud infrastructure. Samsung posted solid earnings by responding to new mobile device launches and demand for higher density products. The Company also focused on value-added and high-density SSD for servers.

For DRAM, server demand stayed strong owing to the ongoing shift to higher density and expansion of data center infrastructure. PC demand remained robust, driven by increasing demand from large OEMs, while strong gaming demand helped the graphics segment. In the mobile market, despite concerns over a slowdown in smartphone growth, increase in memory content per device continued.

For the second half outlook for NAND, adoption of SSD is expected to expand into more sectors and all product segments are projected to use more high-density eStorage. For servers, demand for SSD for data centers is forecast to remain strong, while for enterprise, adoption of high-density server SSD over 8TB is expected to continue.

In mobile, demand for high-density storage for new smartphones and high-end models is likely to remain robust. Samsung will increase server SSD supply and respond to high-density eStorage demand based on 64-layer 3D NAND products and competitiveness of high-density solutions.

As for the second half DRAM outlook, strong demand from all applications is expected to continue. For servers, demand growth is forecast to persist due to expansion of data center demand from the US and Chinese markets, while high-performance cloud services are also projected to launch.

In mobile, in addition to new flagship smartphone launches, memory content is projected to increase in mid-range models as they begin to support high-specification mobile games, on-device AI and dual camera features. In addition, PC demand will be driven by back to school sales, while graphics demand will be led by the buildup for game consoles. Samsung will focus on strengthening product competitiveness via continuous expansion of 10 nanometer-class technology migration and expanding sales of high value-added products, such as high-density server DRAM, HBM2 and LPDDR4X.

In the mid- to long-term, the trend toward high-performance and higher density servers for data centers is expected to continue due to expansion of AI-related services based on machine learning and adoption of in-memory database. In mobile, demand growth is projected to continue, as the need for high-performance devices increases with the rise of high-density content. Samsung will closely monitor the market condition and the supply and demand conditions of each segment to maintain sustainable earnings in the mid- to long-term with the industry’s leading technology.

For the System LSI Business, overall earnings declined due to weaker demand for mobile application processors and DDIs, but demand for image sensors continued to increase on the back of higher adoption of dual cameras from Chinese smartphone manufacturers. In the third quarter, earnings are expected in increase QoQ on demand for image sensors and DDIs amid strong seasonality for smartphones.

In the second half, overall earnings are projected to improve compared with the first half, led by strong demand for OLED DDIs and high-pixel image sensors. In addition, Samsung plans to diversify its customer base for mobile APs from China and develop chips for use in automotive and IoT applications. Mid- to long-term, the Company will focus on developing chipsets for 5G, multiple cameras and display panels, seeking to achieve higher growth compared to that of the market.

For the Foundry Business, total earnings continued to grow QoQ due to strong demand for High Performance Computing (HPC) chipsets, mobile APs and image sensors. In addition, by securing orders for 8-inch specialty products, the Company has established a base for achieving stable earnings going forward. Earnings are expected to be solid in the second half on the back of higher demand for mobile APs and image sensors. Samsung will also strengthen process technology leadership by beginning 8-nanometer mass production and EUV-based 7-nanometer test production.

The Company expects revenue to exceed USD 10 billion in 2018, following sales of USD 9.8 billion in 2017, securing a strong second place in the foundry market.

Display to Rebound in Second Half Led by Flexible OLED

The Display Panel Business posted KRW 5.67 trillion in consolidated revenue and KRW 0.14 trillion in operating profit for the quarter.

For OLED, earnings decreased QoQ despite improved factory utilization for rigid products, as demand from major customers for flexible panels remained slow. Earnings from LCD also declined from the previous quarter as the shipment and average panel price continued the downward trend.

Looking ahead to the second half, OLED sales are expected to rebound on recovering demand for flexible displays. Samsung aims to increase market share by actively addressing customer demand while enhancing technological and price competitiveness. The Company will incorporate more value-added features into panels and reinforce its competencies in new applications such as foldable displays, seeking new growth drivers.

For LCD, Samsung expects demand to grow in the second half for premium TV panels that are used in high-resolution and ultra-large models, amid peak seasonality. Intensified competition and the industry’s capacity expansion will limit improvements in profits, but the Company will continue to focus on profit with differentiated high-end products such as Quantum Dot and 8K resolution TV panels.

Mobile Posts Sluggish Sales, Networks Grows on LTE Expansion

The IT & Mobile Communications Division posted KRW 24.0 trillion in consolidated revenue and KRW 2.67 trillion in operating profit for the quarter.

Amid the sluggish premium smartphone market and intensifying competition, Samsung’s smartphone shipments and revenue declined QoQ due to the slow sales of Galaxy S9 and S9+ as well as the phasing out of older low-end models.

The Company posted a drop in quarterly operating profit due to higher marketing expenses. Meanwhile, the Networks Business saw a healthy sales growth as major overseas carrier partners increased investments in LTE expansion.

Demand for smartphones and tablets is forecast to increase in the second half as the market enters a period of strong seasonality, but competition is seen intensifying as new smartphone models are released. In response, Samsung will seek to expand sales by introducing a new Galaxy Note earlier than usual, which offers exceptional performance for a reasonable price. Also, Samsung plans to strengthen price competitiveness and adopt advanced technology in the mass models.

Looking to the future, the Company will continue to reinforce product competitiveness based on hardware leadership, by adopting cutting-edge technology and new form factors and gaining leadership in 5G. Furthermore, based on the ever-evolving Bixby ecosystem which connects smartphones, TVs, refrigerators and other IoT devices, Samsung aims to offer personalized service to customers and create synergy with other services such as Samsung Pay.

As for the Networks Business, the Company will supply its major partners with 5G network solutions and continue to invest to become the global leader in next-generation network solutions.

Consumer Electronics to Maintain Premium Market Leadership

The Consumer Electronics Division, including the Visual Display and Digital Appliances businesses, posted KRW 10.4 trillion in consolidated revenue and KRW 0.51 trillion in operating profit for the second quarter.

The overall TV market saw demand grow from a year ago as a major global soccer event lifted sales. Samsung reported a significant boost in earnings in the TV business due to strong sales of its premium products, including QLED and ultra-large screen TVs.

Following a successful restructuring of its product line-up, Samsung led expansion of the premium TV market, winning more than 50% market share in the ultra-large screen segment of 75-inches and above.

For the Digital Appliances Business, the overall market decreased YoY largely due to the instability in emerging markets, although developed markets posted a moderate growth. Samsung continued to expand sales of its premium products in the second quarter, including the Family Hub refrigerator and premium air purifier “CUBE”. However, earnings decreased slightly YoY, due to weak demand for air conditioners.

Looking to the second half, the TV market is projected to grow YoY, especially in developed economies. Samsung will work to further improve profitability by focusing on sales of premium TVs and maximizing shipments during the year-end peak season. The Company’s second half release of the industry’s first AI- based 8K QLED TV is expected to further solidify its position as a leader in the premium TV market.

As for the Digital Appliances Business, the Company will focus on profits by enhancing peak-season promotions in key regions including Black Friday, and expanding sales of premium products and built-in home appliances.

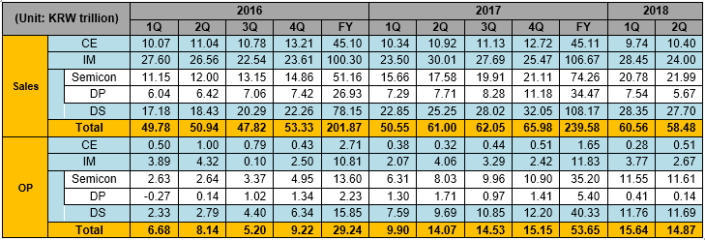

※ Consolidated Sales and Operating Profit by Segment based on K-IFRS (2016~2018 2Q)

Note 1: Sales for each business include intersegment sales

Note 2: CE (Consumer Electronics), IM (IT & Mobile Communications), DS (Device Solutions), DP (Display Panel)

Note 3: Information on annual earnings is stated according to the business divisions as of 2018.

Note 4: From Q1 2018, earnings from the Health & Medical Equipment Business (HME) are excluded from the CE Division